The domestic market is subject to the fall in demand for Latin American wine

Global consumption: regional statistics show that confinement made Latin Americans choose to drink a little more wine.

Global consumption: regional statistics show that confinement made Latin Americans choose to drink a little more wine.

The White House confirmed that 25% tariffs on Mexico and Canada, along with 10% on China, will begin February 1. Mexican President Claudia Sheinbaum responded, emphasizing preparedness and ongoing dialogue.

Peso Pluma, the trailblazing Mexican artist, will receive the BMI Champion Award at the 2025 BMI Latin Awards for his global impact on Música Mexicana. Tito Double P, instrumental to Peso Pluma's success and a rising star himself, will receive the BMI Impact Award.

From Lunar New Year celebrations in Cancun to innovative scientific breakthroughs with organs-on-chips technology. Discover travel tips, retirement advice, cultural insights, and culinary adventures, including a bold Oaxacan Negroni twist.

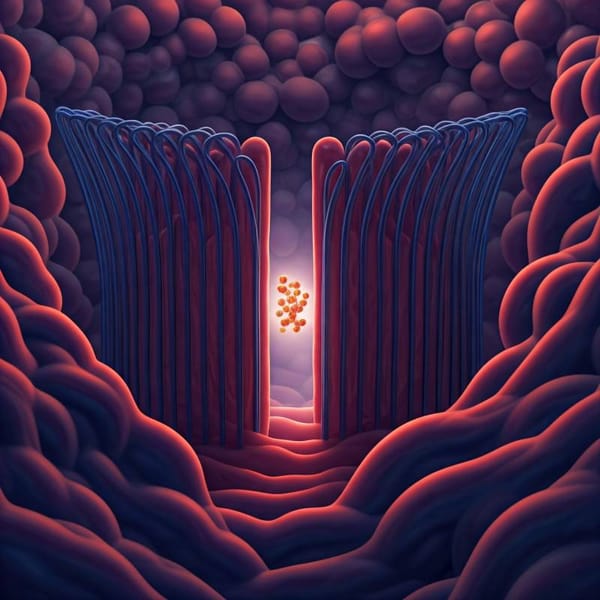

Scientists develop "organs-on-a-chip" to revolutionize drug testing. These miniature devices mimic organ functions, allowing researchers to test drug efficacy on patient cells before prescription.