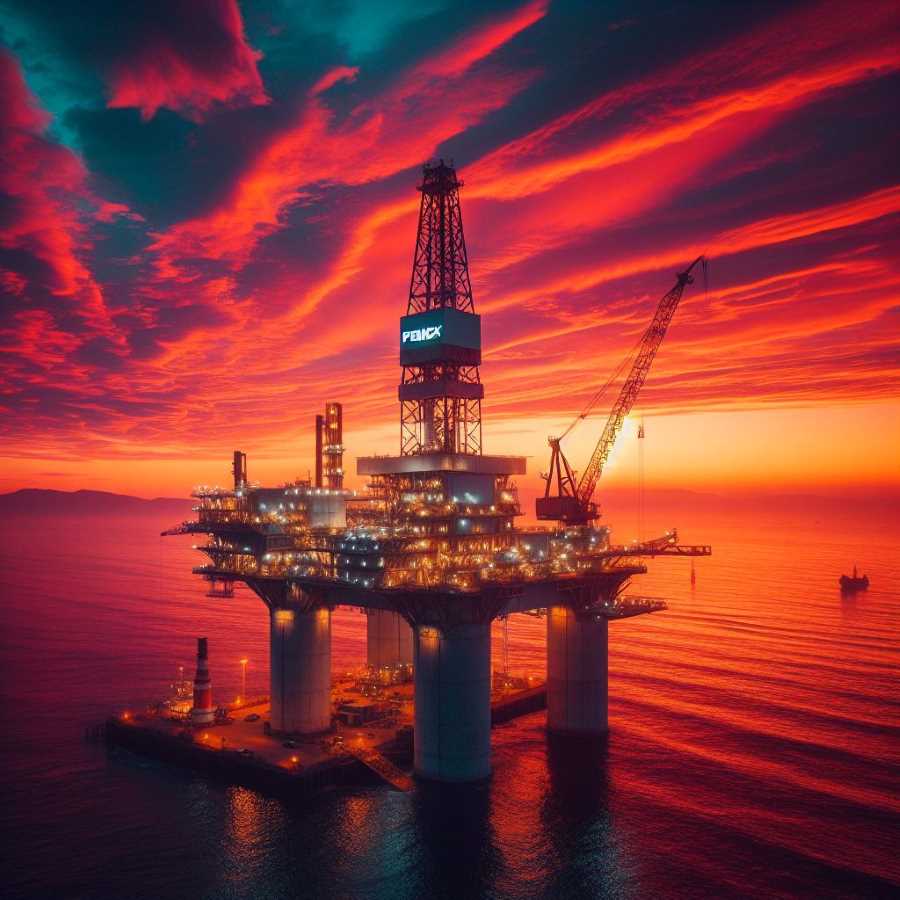

Pemex Bets on Self-Reliance in a Changing World

86 years after Mexico seized its oil, Pemex navigates a comeback amidst staggering debt. Energy independence is the goal, but a strengthening peso and the oil giant's financial burden cast a shadow. The world still needs oil, but Pemex's future hinges on overcoming debt.

86 years ago, General Lázaro Cárdenas del Río shook Mexico – and the global oil industry – to its very core. With a defiant decree, Mexico wrested control of its national oil from the vice-like grip of 17 foreign companies. The Oil Expropriation of 1938 was audacious, born of economic frustrations and a fiery nationalist spirit. It was also the moment Petróleos Mexicanos, or Pemex, entered the world stage – a state-owned titan of oil destined to become a symbol of both wealth and weighty responsibility.

Now, as we commemorate yet another anniversary of this historic event, it's time to look at what Pemex is today. Forget dry statistics and somber forecasts; this is about exploring the curious duality within this iconic company. Pemex, after all, is as much of a paradox as Mexico itself.